ABOUT

Lighting the way

Seeking Alpha

APPROACH

Investment

strategies

Constellation mainly focuses on Value-Add and Core-Plus strategies. We believe that these investment strategies yield appropriate risk-adjusted returns in relation to investor exposure, which is typically minimized through in-place income. Opportunistic investments are reserved for extraordinary properties that meet certain criteria, including barrier to entry markets, low basis and strong sponsorship. We acquire assets in specific sunbelt metro areas with proven demographics, barriers to entry and strong economic demand drivers.

We seek to identify high-quality properties in locations with a clear and sustainable path towards growth and value creation. We aim to consistently study target markets and track demand driver metrics.

Constellation seeks both return driven and yield driven opportunities in the realm of primary asset classes (multifamily, retail and office)

UNIQUE ATTRIBUTES WITH HIGH BARRIERS TO ENTRY

STRONG ECONOMIC DEMAND DRIVERS

ROBUST ECONOMIC AND DEMOGRAPHIC STATISTICS

CORE VALUES

Our values represent the core of our essence as a real estate investment firm and provide the framework for our daily and long term relationships. Through collaboration and thoughtful diligence, we are able to perform seamless executions of investments from start to finish. Our integrity is of the utmost importance as a fiduciary agent, and our family office approach provides the disciplined agility necessary to identify emerging market trends.

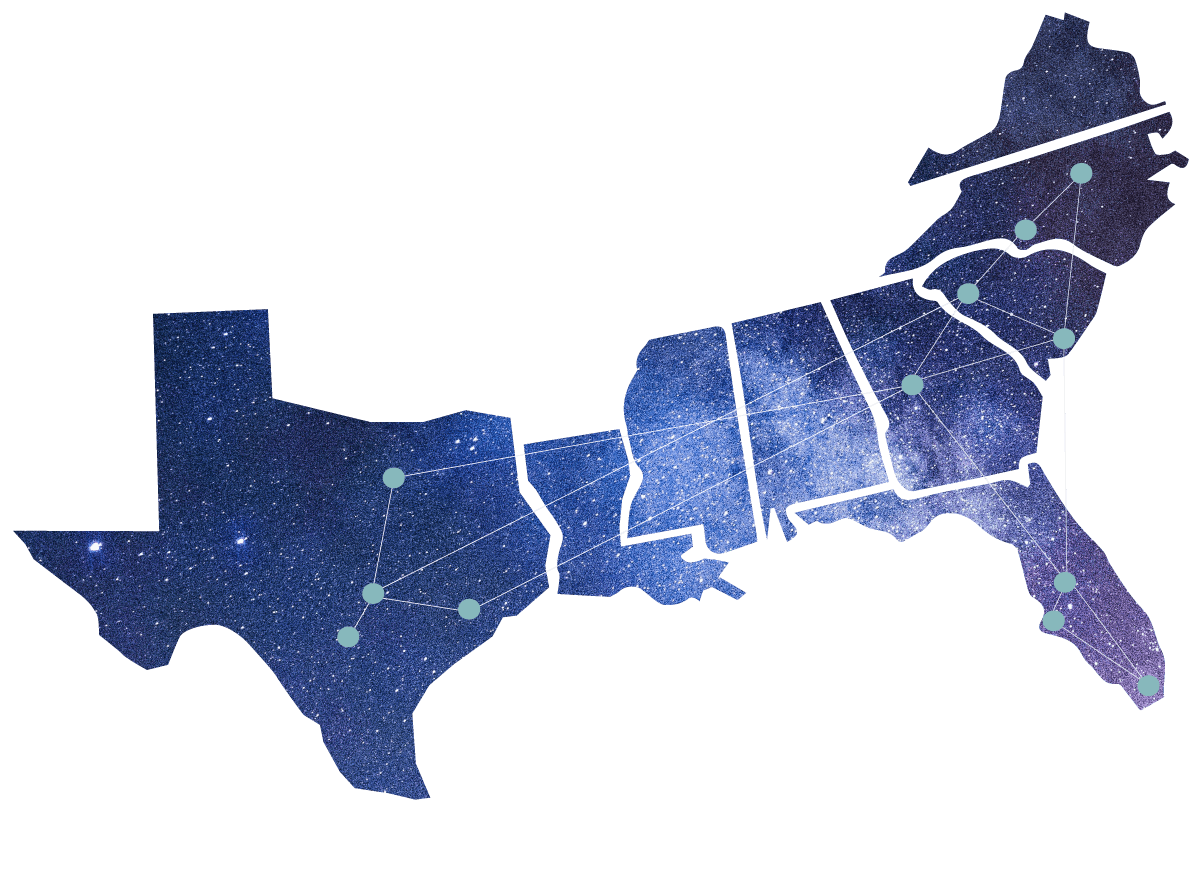

Target markets

We consistently analyze target markets by tracking demand driver metrics to identify growth and undervalued markets. As a result, Constellation focuses on acquiring assets in specific SOUTHEAST metro-areas that have proven market fundamentals.

IDENTIFYING MARKETS

Constellation seeks to identify asset classes within or abutting metro areas with desirable living conditions and strong demand drivers. Constellation emphasizes on the following (see below)

UNIQUE ATTRIBUTES WITH HIGH BARRIERS TO ENTRY

STRONG ECONOMIC DEMAND DRIVERS

ROBUST ECONOMIC AND DEMOGRAPHIC STATISTICS

Austin, TX

San Antonio, TX

Dallas, TX

Houston, TX

ATLANTA, GA

Orlando, FL

Tampa, FL

Charleston, SC

CHARLOTTE, NC

NC RALEIGH, NC

DURHAM, NC

GREENVILLE, SC

MIAMI, FL

PORTFOLIO

OUR PROPERTIES

Constellation focuses on acquiring assets in specific sunbelt metro areas with proven demographics, barriers to entry and strong economic demand drivers

OUR PEOPLE

TEAM

Our extensive experience across all facets of the commercial real estate process allows us to navigate market, legal, diligence and other complexities with confidence and certainty.

ALEXANDER B. PETERS

VP OF ACQUISITIONS

EDUARDO I. OTAOLA

PRINCIPAL

LISSET AVILA

VP OF OPERATIONS

OUR PEOPLE

TEAM

Constellation’s advisory board is comprised of various individuals with extensive experience and track records. The advisory board is continuously involved in Constellation’s trajectory and evolving investment thesis.

EDUARDO I. OTAOLA

MANAGING PRINCIPAL

ALEXANDER B. PETERS

VP OF ACQUISITIONS

TREVOR REGENSBURG

VP OF ASSET MANAGEMENT

ALFONSO OROZCO

PROJECT MANAGER

TEAM

LEADERSHIP

Constellation’s advisory board is comprised of various individuals with extensive experience and track records. The advisory board is continuously involved in Constellation’s trajectory and evolving investment thesis.

Ready to get in

touch with us?

If you are interested in investing with us or wish to get in touch please continue to the contact section.